More Than One in Ten Americans Surveyed Invest in Cryptocurrencies

Survey: The majority of crypto investors are under 40 and do not have college degrees; two-fifths are women and/or investors of color.

CHICAGO, July 22, 2021 – Thirteen percent of Americans surveyed report purchasing or trading cryptocurrencies in the past 12 months, according to a new survey conducted by NORC at the University of Chicago. This figure is slightly more than half of that of survey respondents who reported trading stocks (24 percent) over the same period.

According to researchers from NORC, the average cryptocurrency trader is under 40 (mean age is 38) and does not have a college degree (55 percent). Two-fifths of crypto traders are not white (44 percent), and 41 percent are women. Over one-third (35 percent) have household incomes under $60k annually.

“Cryptocurrencies are opening up investing opportunities for more diverse investors, which is a very good thing,” says Angela Fontes, a vice president in the Economics, Justice, and Society department at NORC at the University of Chicago. “It will be important that these investors have access to sound information as they make decisions related to these often more volatile investments.”

Investing in cryptocurrency is a relatively new investment choice, as most investors started investing in cryptocurrencies within the past six months (61 percent). Investors get their information about cryptocurrency investing mostly through the crypto exchanges themselves (26 percent), general trading platforms like Fidelity or Robinhood (25 percent), or social media (24 percent). Only 2 percent get information from a broker or advisor.

Spotlight on Personal Finance

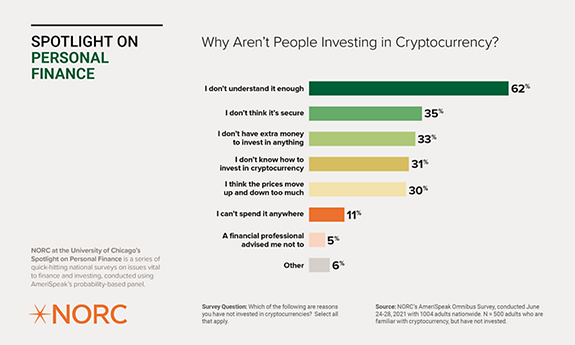

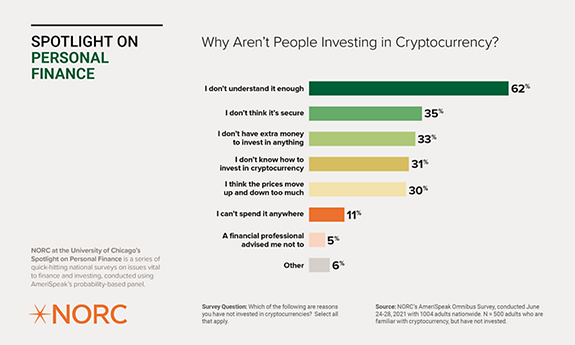

Why Aren't People Investing in Cryptocurrency

According to the survey researchers, hesitancy around investing in cryptocurrencies is less related to a lack of investable (disposable) cash and more related to a lack of understanding the market. Almost two-thirds (62 percent) of respondents indicated they did not understand cryptocurrency enough to invest, while only one-third said they did not have the money to buy into cryptocurrencies (33 percent). Other reasons cited included concerns around security (35 percent), not knowing how to invest (31 percent), and concerns about price volatility (30 percent).

Among those not investing in cryptocurrency, only one in ten (11 percent) indicated they were extremely or somewhat likely to begin trading in the next 12 months, suggesting that the market for these alternative investments may hold steady.

“Cryptocurrency is a relatively new option for retirement funds. Potential investors are leery of investing their retirement savings into what has been, to date, a fairly volatile investment,” says Mark Lush, a manager in the Economics, Justice, and Society department at NORC. “Cryptocurrencies may have staying power as an investment option, but our hunch is that they will continue to lag behind more traditional investment opportunities for the foreseeable future.”

On August 23, 2021, this release was revised to remove demographic comparisons between stock and cryptocurrency investors as these comparisons were not statistically significant at the p<.05 level.

Methodology

The self-funded poll was conducted between June 24 and June 28, 2021, during a monthly Omnibus survey. It included 1,004 interviews with a nationally representative sample (margin of error +/- 4.34 percent) of adult Americans aged 18+ using the AmeriSpeak Panel. AmeriSpeak® is NORC’s probability-based panel designed to be representative of the U.S. household population. A comprehensive listing of all study questions, tabulations of top-level results for each question.

About the Spotlight on Personal Finance

NORC at the University of Chicago’s AmeriSpeak® Spotlight on Personal Finance is a series of quick-hitting national surveys on issues vital to finance and investing, conducted using AmeriSpeak’s probability-based panel.

About NORC at the University of Chicago

NORC at the University of Chicago conducts research and analysis that decision-makers trust. As a nonpartisan research organization and a pioneer in measuring and understanding the world, we have studied almost every aspect of the human experience and every major news event for more than eight decades. Today, we partner with government, corporate, and nonprofit clients around the world to provide the objectivity and expertise necessary to inform the critical decisions facing society.

Contact: For more information, please contact Eric Young at NORC at young-eric@norc.org or (703) 217-6814 (cell).