Older Adults Expect to Dig Deeper into Their Wallets in 2024

Foresight 50+

Foresight 50+ by AARP and NORC offers deep insight into the views and behaviors of Americans 50 and older.

For inquiries, contact us:

January 2024

Older adults anticipate spending more across a range of expenses despite no increased income in 2024, according to a new Foresight 50+ Omnibus.

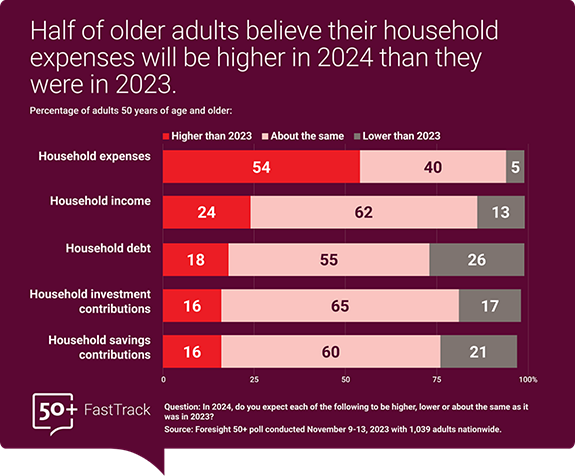

Half of adults 50 years of age and older believe their 2024 household expenses will be higher in 2024 than in 2023, but only a quarter expect their income to increase. One in five older adults expect their household debt will be higher next year as well.

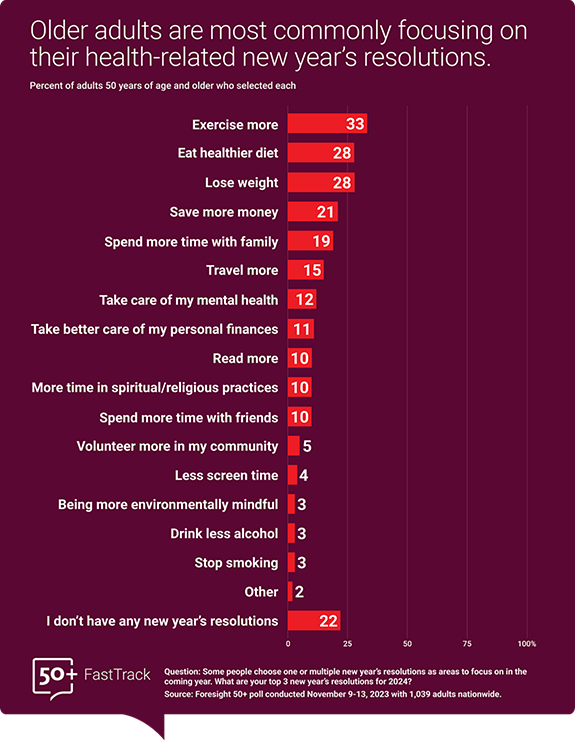

Despite these financial concerns, the most popular new year’s resolutions among older adults focus on health, not finance.

Adults are expecting more of the same, with increasing expenses outpacing income.

Overall, 56 percent of adults 50 years of age and older believe their finances will stay the same in 2024 as they were in 2023. While 26 percent believe their finances will improve, 17 percent believe their finances will get worse.

That outlook includes the expectation that household expenses will continue to outpace increases in income. Half of older adults anticipate their personal expenses will continue to increase into 2024. Only 24 percent believe their income will be higher, and 18 percent believe their debt will be higher in 2024.

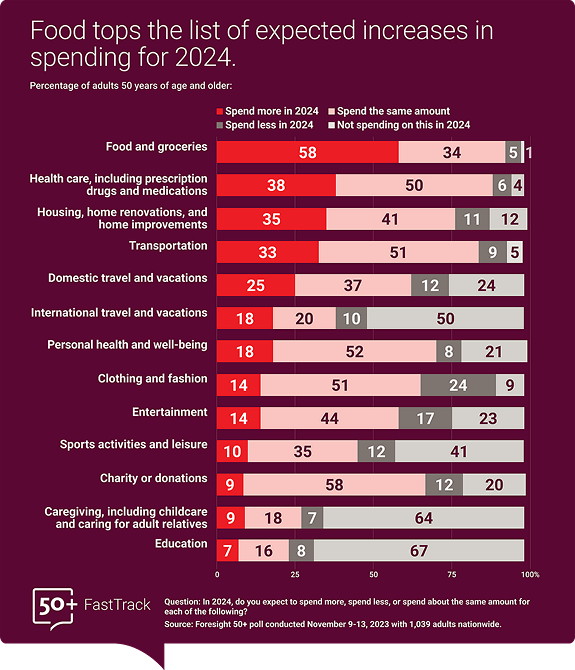

Older adults are anticipating increasing expenses from food and groceries, healthcare, housing, and transportation. Nearly 60 percent of older adults believe they will spend more on food and groceries in 2024 than they did in 2023, while a third or more believe the same about healthcare, housing, and transportation.

Interestingly, despite expecting rising expenses, many older adults are still planning to spend on discretionary items. Almost 50 percent said they will spend the same amount or more on domestic travel and vacations, about 60 percent will spend the same or more on entertainment, and 75 percent will spend the same or more on clothing and fashion. It’s clear that despite increased costs, this group still has money to spend.

Surveyed older adults are also generous. Almost 70 percent of them say they will continue to give the same or more in donations to charity.

In spite of their mixed 2024 financial forecast, older adults are focusing on health-related new year’s resolutions.

Older adults report exercising more, eating a healthier diet, and losing weight as their top three new year’s resolutions. Though older adults have concerns about their 2024 finances and expenses, more traditional resolutions around wellbeing beat out financial ones for new year’s resolutions. Financial health is still a goal for some with 21 percent resolving to save more and 11 percent who want to take better care of their personal finances in 2024. 22 percent reported not having any new year’s resolutions.

These findings come from online and telephone (landline and mobile) interviews with 1,039 U.S. adults on the Foresight 50+ Omnibus Survey November 9-13, 2023. The margin of sampling error was +/- 4.2 percentage points. The Foresight 50+ Omnibus survey uses the probability-based panel, Foresight 50+, which was developed by AARP and NORC.

This is part of a new series of Foresight 50+ Omnibus panel surveys focused on amplifying the voices of people fifty and over. Now more than ever, policymakers and others need this type of scientifically rigorous and readily available data in real time to help them improve policies and programs for an aging population. The Foresight 50+ FastTrack series—a set of periodic insights using the panel—will meet this need by regularly providing key findings and insights on an array of topics that might otherwise be unavailable to the public. The series will also showcase ways in which your organization can use the panel to answer your questions about the highly influential 50+ demographic.

The large Foresight 50+ panel can oversample a variety of target groups, such as Medicare beneficiaries, grandparents, frequent travelers, and others. Combined with our affordable TrueNorth methodology, Foresight 50+ can incorporate data from lower-quality sample sources to gain insight into even smaller subpopulations, such as people with food allergies, veterans, and those with various health conditions.

For more information on our other surveys, or to learn how we can customize a survey of this demographic to your needs, visit our website or email Foresight50-bd@norc.org. To learn more about how NORC delivers objective, nonpartisan insights and analysis that decision-makers trust across other issue areas and demographics, explore our website.