Retired and Working Older Adults React Differently to Economic Pressure

Foresight 50+

Foresight 50+ by AARP and NORC offers deep insight into the views and behaviors of Americans 50 and older.

For inquiries, contact us:

December 2023

Many older, working adults are changing how they prepare for retirement because of the current national economy.

That finding comes from a new Foresight 50+ Omnibus survey that uses the probability-based panel, Foresight 50+, which was developed by AARP and NORC.

It might come as no surprise that age matters when it comes to retirement. Adults 65 and older are more likely to be retired, while around half of adults 50 to 64 years old are working full-time. Most of the currently retired adults did so before turning 65.

The Grass Is Greener on the Retired Side

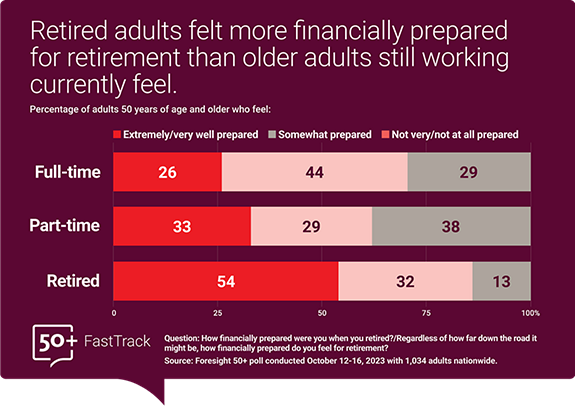

Older adults still in the workforce feel more uneasy about their financial outlook in retirement than their retired counterparts.

Only a quarter of adults over 50 who are working full-time feel extremely or very well prepared financially for retirement. Three-quarters of these adults say they will wait to retire until age 65 or later, including 23 percent who say they will never retire.

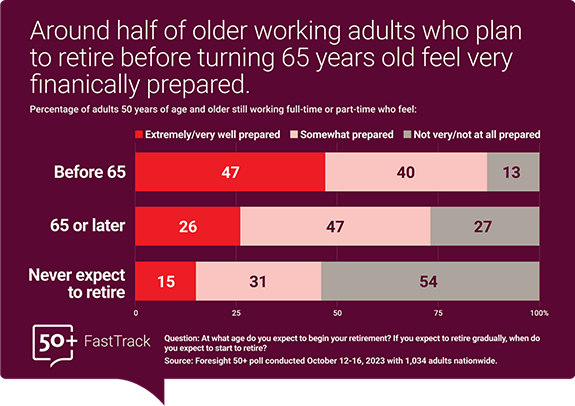

Some adults will retire despite their financial readiness. Of those adults who plan to retire before 65, around half feel extremely or very well prepared for retirement. For those planning to retire after 65, only 26 percent feel extremely or very well prepared.

Older adults already in retirement were a little more optimistic when they retired. Just over half of retired adults felt extremely or very well financially prepared for retirement when they retired.

Challenging Times, Changing Habits

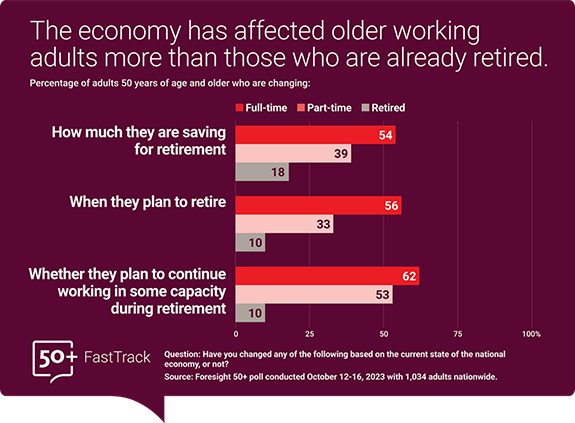

Despite their concerns, older adults are being choosy about how they adjust to the economic pressure, and those not yet retired are making the biggest changes. Because of the current economy, at least half of older adults still working full-time have changed their retirement saving habits, when they plan to retire, and how much they plan to work during retirement.

Older adults not yet into retirement are also planning to work longer. Over 60 percent of those working full-time changed whether they plan to continue working in some capacity during retirement, compared to only around 10 percent of their retired counterparts.

Despite economic concerns, retired older adults are less likely to set a new course. Only 18 percent of retired adults are changing how much they save for retirement compared to 54 percent of those still working full-time.

In all, adults already in retirement seem to feel more confident in their decisions and finances, while those not yet retired feel like they are facing more challenges.

These findings come from online and telephone (landline and mobile) interviews with 1,034 U.S. adults on the Foresight 50+ Omnibus Survey October 12-16, 2023. The margin of sampling error was +/- 4.2 percentage points.

This study is part of a new series of Foresight 50+ Omnibus surveys focused on amplifying the voices of people fifty and over. Now more than ever, policymakers and others need this type of scientifically rigorous and readily available data in real time to help them improve policies and programs for an aging population. The Foresight 50+ FastTrack series—a set of periodic insights using the Foresight 50+ panel—will meet this need by regularly providing key findings and insights on an array of topics, that might otherwise be unavailable to the public. The series will also showcase ways your organization can use the panel to answer your questions about the highly influential 50+ demographic.

The Foresight 50+ panel can oversample a variety of target groups, such as Medicare beneficiaries, grandparents, frequent travelers, and others. Combined with our affordable TrueNorth methodology, Foresight 50+ can incorporate data from lower-quality sample sources to gain insight into even smaller subpopulations, such as veterans or people with food allergies or other health conditions.

For more information on our other surveys or to learn how we can customize a survey of this demographic to your needs, visit our solution page or email Foresight50-bd@norc.org.